April 6, 2022, Hong Kong – Real estate private equity firm Gaw Capital Partners announced today that the firm, through a fund under its management, has acquired Fuchu Building located in Fuchu Intelligent Park in Fuchu City, a well-established data center cluster less than 30km from central Tokyo.

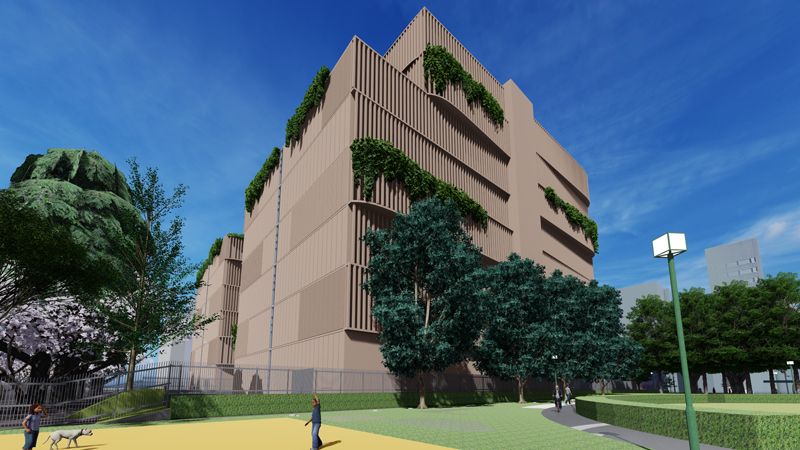

The property is adjacent to Meito Sangyo Building in Fuchu Intelligent Park, an asset acquired in July 2021 by a fund under Gaw Capital’s management that has been under construction to redevelop into a carrier-neutral Tier III data center as Phase I. Fuchu Building will be demolished and redeveloped into Phase II of the data center. The site enjoys convenient access via three subway stations within close walking distance.

The land size of Fuchu Building is 5,479 sqm. With this new land, the scale of the new data centers will double to a total land size of 10,969 sqm. Subject to final design, the IT capacity of the data centers is expected to double to 39 IT MW (4,040 racks), with a total power capacity of 50 MW, which will make it the largest data center facility in Fuchu City in terms of IT load.

Kok Chye Ong, Managing Director – Head of IDC Platform, Asia (Ex-China) of Gaw Capital Partners, said, “Gaw Capital is delighted to have our Internet data center (IDC) portfolio continue to grow in Japan with the transactions of these two projects completed. Due to the technological advancements in 5G communications, 4K transmission, Internet of Things (IoT), artificial intelligence, auto-driving and more, there is an ever-growing amount of data traffic driving the demand for data centers to consolidate servers, store data and manage network transport. Gaw Capital Partners sees its IDC development as part of a bigger story and will continue to make it a focus sector in the future.”

Isabella Lo, Managing Director, Head of Japan of Gaw Capital Partners, added, “The acquisition brings significant strategic value to the combined project as well as our Pan-Asia IDC platform, as the increased scale and expansion capacity is highly attractive to operators and hyperscale tenants. We see great opportunities in Japan’s real estate market and look forward to exploring further opportunities across various property sectors in the country.”

Gaw Capital Partners entered the Japan market in 2014 through its first investment in Hyatt Regency Osaka and successfully exited as the second largest hotel deal in Osaka in 2016. Additional properties in Japan under Gaw Capital Partners’ portfolio include Aoyama Building in Tokyo, H Beauty & Youth Flagship Store in Tokyo, Renaissance Okinawa Resort and Coco Garden Resort in Okinawa, Minatomirai Center Building in Yokohama, a residential portfolio located in Tokyo, Osaka, Kyoto, Sapporo, Nagoya and Yokohama, Toyobo Building in Osaka, Matsushita IMP Building in Osaka, and a portfolio of 18 office assets primarily in Tokyo.

Gaw Capital Partners was named ‘Alternatives Investor of the Year: Asia’ at the PERE Awards 2021 after receiving the largest number of votes in a public ballot of the real estate industry. In recent years, IDC has been a focus sector for Gaw Capital Partners as the data center industry is one of the cornerstones of the digital economy, which is growing rapidly with broad prospects. The firm was also highlighted for launching two data center platforms in China and one in pan-Asia. In September 2020, the firm closed fundraising for its first IDC platform, which invested in a portfolio of projects in partnership with IDC developers and operators in China, bringing the total equity raised to approximately US$1.3 billion with the aim to build “green, efficient, innovative and recyclable” data center clusters.

– End –

About Gaw Capital Partners

Gaw Capital Partners is a uniquely positioned private equity fund management company focusing on real estate markets in Asia Pacific and other high barrier-to-entry markets globally.

Specializing in adding strategic value to under-utilized real estate through redesign and repositioning, Gaw Capital runs an integrated business model with its own in-house asset management operating platforms in commercial, hospitality, property development, logistics, IDC and education. The firm’s investments span the entire spectrum of real estate sectors, including residential development, offices, retail malls, serviced apartments, hotels, logistics warehouses and IDC projects.

Gaw Capital has raised seven commingled funds targeting the Greater China and APAC regions since 2005. The firm also manages value-add/opportunistic funds in Vietnam and the US, a Pan-Asia Hospitality Fund, a European Hospitality Fund, a Growth Equity Fund and provides services for separate account direct investments globally.

Since 2005, Gaw Capital has commanded assets of US$32.6 billion under management as of Q3 2021.

Gaw Capital Partners, through its funds under management, and its consortium partners, acquired 29 Hong Kong-based community shopping centers and associated facilities in March 2018 and March 2019.

Gaw Capital Partners officially started to operate over 29 assets and facilities near the public estates and established “People’s Place”. “People” stands for the public and the residents, whereas “Place” here is an allusion to the idiomatic Chinese term for a location of virtue and tradition, as well as a well-governed community; “Place” also connotes the solidarity of the local neighborhood. All in all, “People’s Place” stands for a place rich in sentiments and compassion, bringing strangers together in constructing a vibrant, cozy living environment. People’s Place aspires to transform obsolete commercial facilities into vibrant community hubs by creatively utilizing its space and bringing brand new experiences to residents, tenants and community stakeholders.

Gaw Capital Partners, through its funds under management, and its consortium partners, acquired 29 Hong Kong-based community shopping centers and associated facilities in March 2018 and March 2019.

Gaw Capital Partners officially started to operate over 29 assets and facilities near the public estates and established “People’s Place”. “People” stands for the public and the residents, whereas “Place” here is an allusion to the idiomatic Chinese term for a location of virtue and tradition, as well as a well-governed community; “Place” also connotes the solidarity of the local neighborhood. All in all, “People’s Place” stands for a place rich in sentiments and compassion, bringing strangers together in constructing a vibrant, cozy living environment. People’s Place aspires to transform obsolete commercial facilities into vibrant community hubs by creatively utilizing its space and bringing brand new experiences to residents, tenants and community stakeholders.  In partnership with experienced educators in China, Gaw Capital has invested in the development and operations of Stellart International School of Arts (SISA), an international arts education platform in China. The platform is initially seeded by a commercial site conveniently located in Sanshan New Town in Nanhai, Foshan, which has excellent connectivity nationally via the Guangzhou South Station. The site has a GFA of c.50,000 sqm in total. Operating under the SISA brand and developed by Gaw Capital Partners, the school houses up to 600 full-time high school students in its 6-storey tall academic block and 7-floor dormitory.

In partnership with experienced educators in China, Gaw Capital has invested in the development and operations of Stellart International School of Arts (SISA), an international arts education platform in China. The platform is initially seeded by a commercial site conveniently located in Sanshan New Town in Nanhai, Foshan, which has excellent connectivity nationally via the Guangzhou South Station. The site has a GFA of c.50,000 sqm in total. Operating under the SISA brand and developed by Gaw Capital Partners, the school houses up to 600 full-time high school students in its 6-storey tall academic block and 7-floor dormitory.