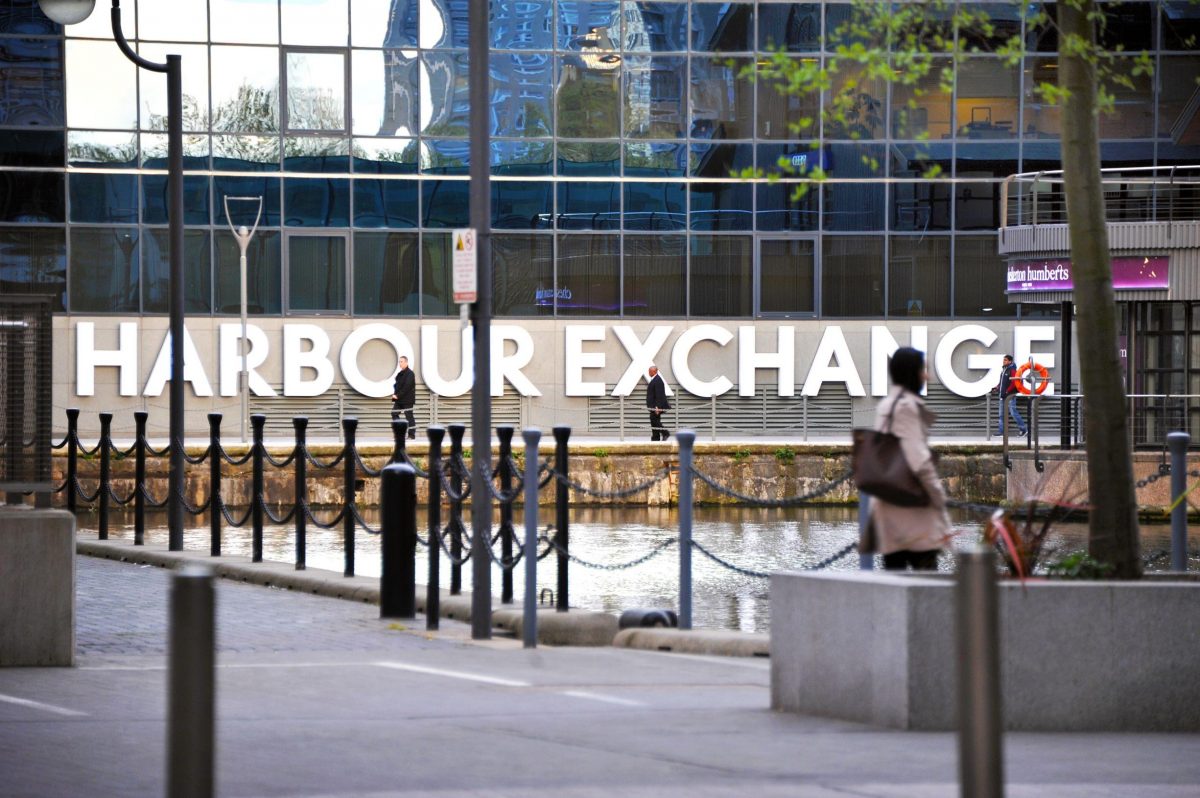

Harbour Exchange is a multi-let office estate in London’s South Quay, Docklands

3 October 2018, London – Clearbell Capital and Gaw

Capital Partners today announces the transaction of 4 and 5 Harbour

Exchange in London, with Clearbell Property Partners II LP (Clearbell) agreeing

to sell Harbour Exchange to Gaw Capital for £36.2m.

The assets, comprising two office buildings in

the Harbour Exchange estate, cover 95,000 sq ft in total. Harbour Exchange is a

multi-let office estate located in the Isle of Dogs, offering one million sq ft

of office space. The site is in close proximity to South Quay DLR station and

is a 10-minute walk to the Canary Wharf estate, with access to the Underground’s

Jubilee Line.

Clearbell acquired Harbour Exchange in February

2014 to cater for businesses looking for cheaper rents in London, having been

priced out of central locations.

A series of asset management initiatives and new

lettings were undertaken to drive income, including:

·

Overhaul of the Mechanical & Electrical (M&E)

throughout

·

More efficient lighting at 4 Harbour Exchange

·

New reception areas and external entrances

·

Five new lettings to new tenants at 4 Harbour Exchange

With over 13 years of investment experience, Gaw

Capital Partners is distinguished for its ability to add strategic value to real

estate through revitalisation, redesign and repositioning. The firm has an

excellent investment track record in the London market, with a number of

strategic and high-potential commercial properties in its portfolio, including Lloyd’s

Building, 123-151 Buckingham Palace Road, Milton Gate and Tower Place.

Dominic Moore, Head of Asset Management at

Clearbell Capital said, “This sale demonstrates an

appetite for prime office space in desirable locations beyond the City of

London. The development of this business hub in the Isle of Dogs is testament

to the attractiveness of peripheral locations in London, as tenants seek

Grade-A space at reasonable rates. We pursued this investment against a

backdrop of rising rents in the City, looking to deliver high quality office

space to high quality tenants being priced out of the City.”

Christina Gaw, Managing Principal and Head of

Capital Markets at Gaw Capital Partners said, “As freeholders of the

Harbour Exchange buildings, this acquisition will enable us to further

consolidate our holdings at the estate. These buildings represent exceptional

value for tenants, providing access to Grade-A office space in a fantastic

location with excellent transport links, at rents far lower than those found in

the West End, City and other fringe locations.”

Partners and Knight Frank acted for Clearbell. Michael Elliott acted for Gaw

Capital.

基滙資本旗下管理基金與共同投資者分別於2018 年3 月及2019 年3 月,先後收購共29 個香港社區商場物業及其相關設施,成立「民坊」品牌。

民坊貫徹「以民為本,以情聚坊」的理念,善用空間,注入創新意念,致力把社區商場打造成社區樞紐,為街坊、租戶及地區持分者帶來嶄新體驗。公司亦善用團隊過往專業設計及物業管理的豐富經驗改善社區設施,提供優質服務及多元購物選擇,並透過積極的社區參與,矢志成為社區的伙伴,提升街坊對社區的歸屬感。

基滙資本旗下管理基金與共同投資者分別於2018 年3 月及2019 年3 月,先後收購共29 個香港社區商場物業及其相關設施,成立「民坊」品牌。

民坊貫徹「以民為本,以情聚坊」的理念,善用空間,注入創新意念,致力把社區商場打造成社區樞紐,為街坊、租戶及地區持分者帶來嶄新體驗。公司亦善用團隊過往專業設計及物業管理的豐富經驗改善社區設施,提供優質服務及多元購物選擇,並透過積極的社區參與,矢志成為社區的伙伴,提升街坊對社區的歸屬感。

基滙資本與中國經驗豐富的教育工作者合作,投資了中國國際藝術教育平台辰美國際藝術學院(SISA)的開發和運營。 該平台最初建於位於佛山南海三山新城的商業地段,鄰近全國內具有良好連貫性的廣州南站,交通便利。 該場地的總建築面積約為 50,000 平方米。該學校以 SISA 品牌運營,由基滙資本開發。其 6 層高的教學大樓和 7 層宿舍可容納逾 600 名全日制高中生。

基滙資本與中國經驗豐富的教育工作者合作,投資了中國國際藝術教育平台辰美國際藝術學院(SISA)的開發和運營。 該平台最初建於位於佛山南海三山新城的商業地段,鄰近全國內具有良好連貫性的廣州南站,交通便利。 該場地的總建築面積約為 50,000 平方米。該學校以 SISA 品牌運營,由基滙資本開發。其 6 層高的教學大樓和 7 層宿舍可容納逾 600 名全日制高中生。