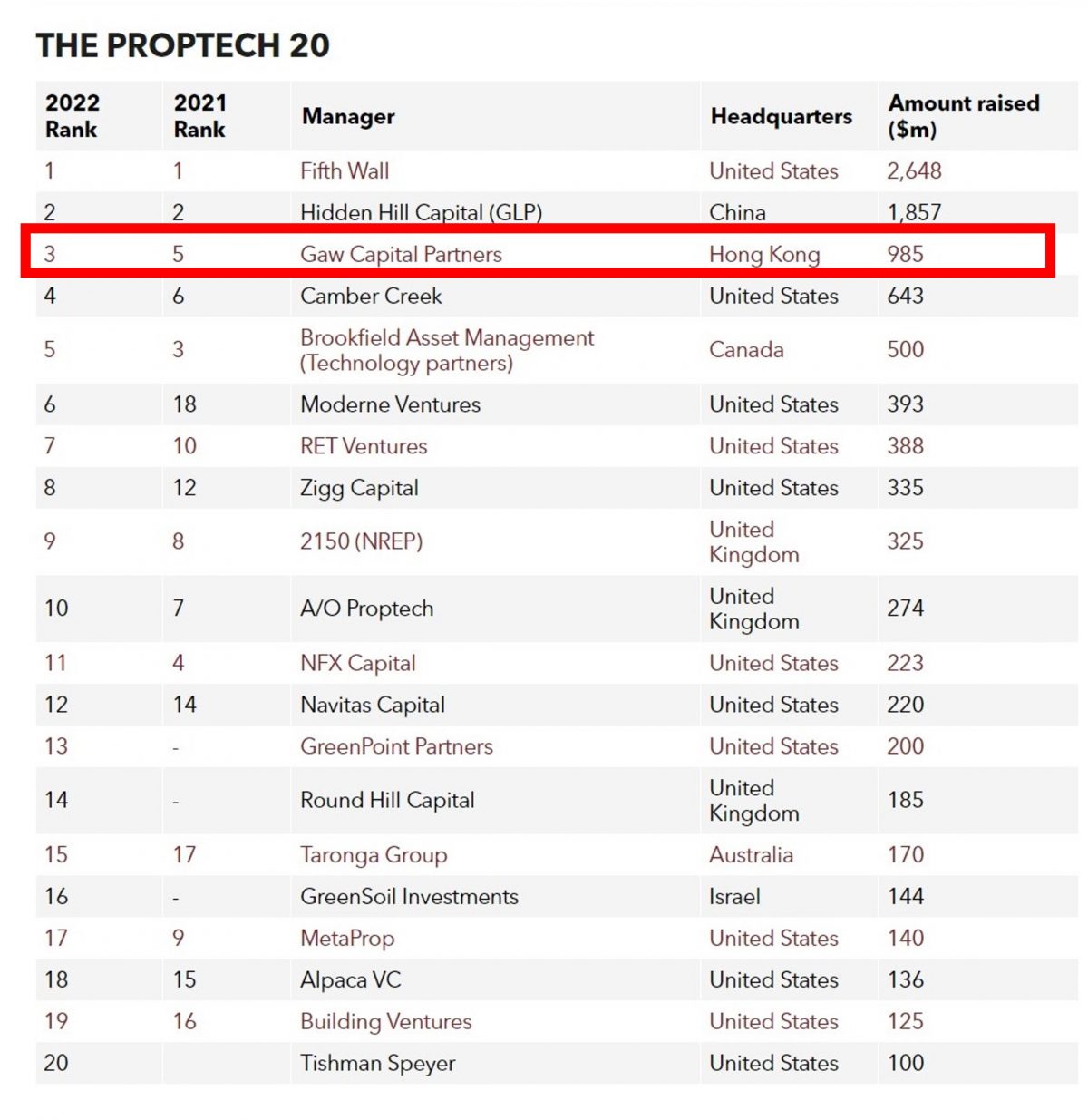

November 7, 2022, Hong Kong – Jumping two spots from last year, Gaw Capital Partners ranked third in PERE’s Proptech 20, PERE’s dedicated property technology fundraising ranking which lists the top 20 managers based on the amount of proptech direct investment capital raised globally since 2017.

Gaw Capital Partners closed its commingled growth equity fund, Gaw Growth Equity Fund I, in 2021, bringing total equity raised for the fund (plus co-investments closed to date) to over US$430 million. At over US$800 million in AUM, Gaw Capital’s venture arm focuses on investing in real estate related tech ventures and operating companies.

Humbert Pang, Managing Principal, Head of China and Co-Chair of Alternative Investments at Gaw Capital Partners, said, “We are thrilled to rank third in PERE’s Proptech 20, which has recognized us for our fundraising capabilities and strong fund management of our proptech venture portfolio. Decision makers at global real estate firms and financial institutions around the world are now placing a strong emphasis on ESG, and Gaw Capital believes that proptech is the solution to improving traditional real estate and building a more sustainable future. We are proud to be an early adopter in this space and will continue to look for new proptech, sustainable development, and green technology investment opportunities and partnerships.”

In addition to deploying capital in proptech, Gaw Capital also leverages its in-depth management expertise and global real estate presence to help our portfolio companies grow. Gaw Capital has realized strong synergies with many of our proptech investments, as our vast real estate portfolio provides the application scenarios for users’ adoptions to new technologies. This adds value to our real estate by improving operational efficiencies and tenant satisfaction, and reducing energy expenditure.

About Gaw Capital Partners

Gaw Capital Partners is a uniquely positioned private equity fund management company focusing on real estate markets in Asia Pacific and other high barrier-to-entry markets globally.

Specializing in adding strategic value to under-utilized real estate through redesign and repositioning, Gaw Capital runs an integrated business model with its own in-house asset management operating platforms in commercial, hospitality, property development, logistics, IDC and education. The firm’s investments span the entire spectrum of real estate sectors, including residential development, offices, retail malls, serviced apartments, hotels, logistics warehouses and IDC projects.

Gaw Capital has raised seven commingled funds targeting the Greater China and APAC regions since 2005. The firm also manages value-add/opportunistic funds in the US, a Pan-Asia Hospitality Fund, a European hospitality fund and a Growth Equity Fund, and it also provides services for credit investments and separate account direct investments globally.

Since 2005, Gaw Capital has commanded assets of US$34.3 billion under management as of Q2 2022.

Gaw Capital Partnersは運用中のファンドを通して、コンソーシアムのパートナーと共に、2018年3月と2019年3月に、29件の香港ベースのコミュニティーショッピングセンターと関連施設を取得しました。Gaw Capital Partnersは、公共不動産付近の29件以上の資産と施設の運営を正式に開始し、「民坊(People's Place)」を構築しました。「民(People)」は一般人と住居を表しており、「坊(Place)」は巧みに管理されたコミュニティーのみならず、美徳と伝統がある場所に対するイディオム的な中国の表現を意味しています。また、「坊」は、現地の近隣の団結も暗示しています。「民坊(People's Place)」は活気に溢れ、居心地の良い生活環境で見知らぬ者を団結させ、気持ちや思いやりが豊かな場所を表しています。「民坊(People's Place)」は、空間を時代遅れの商用施設をクリエイティブで活気あるコミュニティーハブに転換させることを目指しています。

Gaw Capital Partnersは運用中のファンドを通して、コンソーシアムのパートナーと共に、2018年3月と2019年3月に、29件の香港ベースのコミュニティーショッピングセンターと関連施設を取得しました。Gaw Capital Partnersは、公共不動産付近の29件以上の資産と施設の運営を正式に開始し、「民坊(People's Place)」を構築しました。「民(People)」は一般人と住居を表しており、「坊(Place)」は巧みに管理されたコミュニティーのみならず、美徳と伝統がある場所に対するイディオム的な中国の表現を意味しています。また、「坊」は、現地の近隣の団結も暗示しています。「民坊(People's Place)」は活気に溢れ、居心地の良い生活環境で見知らぬ者を団結させ、気持ちや思いやりが豊かな場所を表しています。「民坊(People's Place)」は、空間を時代遅れの商用施設をクリエイティブで活気あるコミュニティーハブに転換させることを目指しています。

中国で経験豊かな教育者と提携し、Gaw Capitalは中国での国際的な芸術教育プラットフォームであるStellart International School of Arts (SISA )の開発と運営に投資してきました。このプラットフォームは、広州南駅から国内的に優れた接続性を有する仏山の南海にある三山ニュータウンにある便利な商業用地で誕生しました。敷地は約50,000m²の総床面積を有しています。SISAブランドで運営され、Gaw Capital Partnersにより開発されたこのスクールは6階建ての校舎と7階建ての寮に最大600人の高校生を収容します。

中国で経験豊かな教育者と提携し、Gaw Capitalは中国での国際的な芸術教育プラットフォームであるStellart International School of Arts (SISA )の開発と運営に投資してきました。このプラットフォームは、広州南駅から国内的に優れた接続性を有する仏山の南海にある三山ニュータウンにある便利な商業用地で誕生しました。敷地は約50,000m²の総床面積を有しています。SISAブランドで運営され、Gaw Capital Partnersにより開発されたこのスクールは6階建ての校舎と7階建ての寮に最大600人の高校生を収容します。