- Introduction

Gaw Capital Partners (“Gaw Capital”) believes that a responsible approach to real estate investment will protect and enhance the value of our investments, thereby enhancing returns for our fund investors. Gaw Capital recognises many of our fund investors share an interest in exploring the implementation of responsible economic, environmental and social practices – henceforth referred to as “sustainability” practices, and are therefore committed to integrating sustainability considerations in the investment and portfolio management process.

This ESG Framework is designed to set out Gaw Capital’s principles, objectives, and management systems for investments and responsible business practices with respect to sustainability.

The scope of this ESG Framework applies to the business units of Gaw Capital, the assets (both operating and in development) and investments that Gaw Capital manages, as well as all employees under Gaw Capital. In cases where Gaw Capital has limited control or influence over a particular asset or investment, Gaw Capital will use its position to encourage sustainable practices where possible.

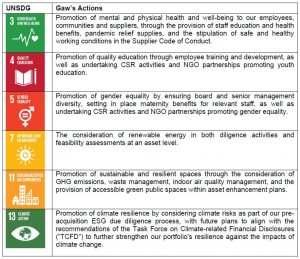

- Our Prioritised Sustainable Development Goals

Gaw Capital is committed to contributing towards the United Nations Sustainable Development Goals (“SDGs”), and embraces the values of the SDGs to address global challenges and build a resilient strategy. We have identified the below six priority SDGs against which we have taken the following actions:

- ESG Focus Areas

Gaw Capital has identified a series of material topics under four focus areas of Business Integrity, Environmental Stewardship, People and Labour Ethics, and Communities that we seek to embed across our business operations and value chain.

3.1 Business Integrity

3.1.1 Corporate Governance and Oversight on ESG Matters

Gaw Capital is committed to upholding a high standard of corporate governance against ESG matters in our business. Our Sustainability Committee chaired by the company’s Managing Principal, is responsible for:

- Overseeing Gaw Capital’s ESG risks and opportunities at a strategic level;

- Ensuring sustainability issues are considered in all business operations, from investment, asset management to risk management; and

- Developing, assessing, and communicating sustainability targets with our stakeholders.

Our business activities are conducted in accordance with a high level of ethical standards in order to maximize the interest of our stakeholders. We maintain a zero tolerance for unethical conduct across all operations against the areas of anti-bribery, anti-corruption, conflict of interests and regulatory compliance. In cases of suspected unethical conduct, concerned parties may raise concerns through our internal anonymous Whistleblowing Channel by reporting to Gaw Capital’s Chief Operating Officer. The Company also seeks to actively manage sustainability risks through conducting comprehensive pre-acquisition ESG due diligence, active monitoring of investments, and observing industry principles. For more information related to our corporate governance, please refer to the Corporate Governance section of Gaw Capital’s website.

3.1.2 Data Security and Privacy

Gaw Capital places a great deal of importance on protecting corporate and stakeholder data by adopting the highest standards of data security and privacy. The Company has implemented data purpose and storage limitation processes and measures such as personal data protection procedures, approach to dealing with data subjects, as well as the request to access and/or correct personal data. For more information, please refer to Gaw Capital’s Personal Data Protection Policy.

3.1.3 Supply Chain Management

Gaw Capital is committed to pursuing sustainability across our value chain. As stipulated in our Supplier Code of Conduct, we expect suppliers to establish appropriate management systems, actively monitor their business operations and uphold standards against business integrity, environmental and social aspects. For further information, please refer to Gaw Capital’s Supplier Code of Conduct.

3.2 Environmental Stewardship

3.2.1 Environmental Performance

Gaw Capital is committed to minimising our environmental impact throughout the real estate development lifecycle, from design, construction to operation. We will do so by making continual improvements to the efficient use of resources and will focus on energy usage, water usage and waste management. Our team of experts will advocate on green design principles, construction methods and operating practices that are tailored for the specific asset type. Environmental performance indicators will be consistently monitored, managed and reported to our investors.

We also seek to enhance sustainability awareness amongst our employees and suppliers through sound environmental strategies, and advocate for good environmental practices at both business unit and individual levels.

3.2.2 Climate Risk and Resilience

Climate change poses a significant challenge to the global landscape, thereby Gaw Capital is committed to reducing such impacts through climate change mitigation and adaptation measures. Climate-related physical and transition risks identified by third-party consultants are taken into consideration in our investment decisions through evaluation by dedicated ESG and investment teams and are incorporated into our business plans.

Our portfolio’s greenhouse gas (“GHG”) emissions are consistently monitored, managed and reported to our investors. Over time, we intend to set realistic GHG emission reduction targets where appropriate, and develop further resiliency responses to the physical and transition risks of our assets.

3.2.3 Ecological Impacts

Gaw Capital recognises the potential ecological impact arising from our business activities. Ecological impact considerations (e.g., biodiversity and habitat) are incorporated in our pre-acquisition due diligence. We will continually track the environmental performance of our business activities in order to reduce negative impact on the environment.

3.2.4 Air Quality

The World Health Organization recognizes that indoor air pollution can pose a potential health risk to building occupants, and as such, Gaw Capital seeks to improve the indoor air quality of its assets through the reduction of indoor air contaminants such as airborne particles, volatile organic compounds (“VOC”), formaldehyde and other harmful contaminants, through measures such as the installation of carbon dioxide monitors, effective ventilation systems, installation of air filters, use of low VOC building materials and others.

3.3 People and Labour Ethics

3.3.1 Human Rights

Gaw Capital supports and respects the protection of internationally proclaimed human rights, as set forth in the United Nations Universal Declaration of Human Rights. We are committed to respecting the fundamental rights to which each individual is entitled, including civil, economic, social and cultural rights in accordance with all applicable laws, and are committed to taking steps for the prevention, mitigation and in identified cases, remediation of human rights issues. The Company does not tolerate any forms of child labour and forced labour in our operations.

Our respect for human rights applies not only to our employees but to all individuals, including but not limited to suppliers, clients, and tenants. Stakeholders are encouraged to report concerns of misconduct without the fear of retaliation through Gaw Capital’s Whistleblowing Channel.

3.3.2 Diversity, Inclusion and Equal Opportunity

Gaw Capital aims to create a fair, responsible and progressive workplace, and embraces diversity by hiring employees based on merit from various backgrounds, cultures and languages. We are committed to a work environment that provides equal opportunities to all our employees in terms of compensation, recruitment, training, promotion, health and safety and other employee benefits and rights, and respects differences in age, gender, ethnicity, religion, nationality, disability, sexual orientation, occupation, family status and others.

3.3.3 Health, Well-being and Safety

Gaw Capital is committed to providing and maintaining safe and healthy working conditions for our employees, and seeks to promote the physical, emotional, intellectual and mental well-being of its employees. Employees are entitled to comprehensive benefits package and health insurance. Gaw Capital also encourages employees to pursue healthy, work-life balanced lifestyles through the provision of flexible working arrangements.

3.3.4 Employee Training and Development

Gaw Capital believes in investing in its people to promote a work environment that emphasizes talent development, career advancement and staff training. We provide career growth progression opportunities through annual employee performance reviews as well as job-related training sponsorship. The Company also supports employees in developing their skillsets through the conduction of relevant trainings and workshops, and may recommend employees for in-house or external courses, seminars or conferences designed to impart knowledge and skills that are needed to enhance performance as work. The Company may also consider the financial support of professional association memberships where relevant to the employee’s role and position.

3.4 Communities

3.4.1 Community Investment

Gaw Capital believes in giving back to the communities in which we operate and seeks to do so by understanding the community’s needs and expectations through active engagements, and making contributions or investments to meet these identified needs. Contributions may include monetary donations, the organization of non-commercial volunteer activities and the sponsoring of various non-governmental organizations. We encourage employees to participate in community programs as volunteers and to support other charitable campaigns that align with the Company’s objectives and the areas in which the local community requires most support.

3.4.2 Community Engagement

Gaw Capital acknowledges the importance of our role in urban renewal of local communities. We aim to deliver sustainable community-based projects that facilitate positive interaction with local communities and cultures where appropriate, and seek to create shared value for communities. When managing our assets, we actively engage with community members wherever practicable in order to understand and meet the needs of local stakeholders. When appropriate, we will partner with non-governmental organizations to promote sustainability values.

- Investment Process

Sustainability is integrated in each phase of the decision-making process relating to Gaw Capital’s investments. The manner in which this will be implemented and monitored will vary across each investment depending on the degree of control that Gaw Capital exercises over the investment, contractual restrictions, local practices and the nature of the asset in question.

Gaw Capital aims to become a signatory of the Principles for Responsible Investment (PRI) in order to contribute to developing a more sustainable global financial system.

When assessing possible investments, sustainability forms part of the due diligence process, for which a process has been developed based on international frameworks such as GRESB and PRI. These sustainability considerations cover environmental, social and governance aspects, such as but not limited to climate change mitigation and adaptation, energy and water efficiency, pollution and waste management, renewable energy, and health and safety conditions.

Based on due diligence findings, Gaw Capital may exclude investing in targets which have major sustainability risks. Scoring low in sustainability performance does not automatically prevent an investment if the target has potential for value creation through improvements in sustainability performance.

- Asset Management

5.1 Assets Managed by Gaw Capital

Gaw Capital believes improvement in sustainability performance can help reposition under-utilized properties hence add strategic value to our portfolio. We are committed to doing so by developing sustainability targets, and through monitoring and quarterly reporting on key sustainability indicators such as: energy and water consumption, and waste management in line with GRESB. In addition, qualitative indicators are reported using the INREV framework covering areas such as Health and Safety, Environmental Management of the asset and Social Governance.

Depending on the asset type, our team will endeavor to implement green asset enhancement initiatives and sustainable operating practices, including but not limited to:

- Energy Management Practices: onsite renewable energy (e.g., solar panels), Energy Management Systems (“EMS”), high-efficiency equipment and appliances such as LED lighting and motion sensors.

- Water Management Practices: automatic meter readings, drought tolerant landscaping, high efficiency water fixtures, leak detection systems and others.

- Waste Management Practices: implementation of reuse, recycling or composting measures where practicable, participation in recycling programmes, and responsible management of treatment and disposal of residual hazardous and non-hazardous waste as needed.

The above practices extend not only to operating properties, but also those that are under construction. To raise the sustainability standards of our portfolio, we will seek to obtain green building certifications for our assets wherever practicable.

Gaw Capital also aims to extend sustainable development understanding to our partners and stakeholders through capacity building initiatives. As managers and operators play an important role in improving the sustainability performance of an asset, training may be provided to these staff covering sustainability practices to adopt in management and operation. Sustainability guidance and training may also be provided to tenants as needed, encouraging tenants to align with our targets and adopt sustainability practices within their property premises.

5.2 Assets with Limited Operating Control by Gaw Capital

Where Gaw Capital has limited control over the management and operation of an asset, we will communicate our sustainability targets to third party property managers, and encourage them to adopt these targets and reporting practices to align with our managed assets (i.e., quarterly reporting on key sustainability indicators such as: energy and water consumption, and waste management in line with the GRESB Performance Indicators reporting requirements).

Similarly, when it comes to relationships with joint venture partners, where Gaw Capital has limited control over the portfolio properties, we will communicate our sustainability targets with investment partners and encourage them to align with Gaw Capital’s targets and reporting practices. Joint venture partners are encouraged to incorporate sustainability considerations into their investment management processes.

5.3 Assets in Development Stage Controlled by Gaw Capital

As a responsible real estate investor, Gaw Capital prioritizes green building development to reduce its environmental impact and promote the well-being of its stakeholders. Working closely with operational partners, we advocate for the integration of sustainability factors in building design and development, such as energy-efficient designs and on-site renewable energy where practicable. Gaw Capital also seeks to promote the use of sustainable materials, including low embodied carbon materials, low-emitting VOC materials, rapidly renewable materials, and recycled content materials where practicable. We will not use red-list-prohibited materials or ingredients and will align with international building standards where possible.

During the construction stage, Gaw Capital prioritizes on-site safety for workers and suppliers, and encourages initiatives such as construction waste management and construction pollution prevention practices. Our project managers monitor all development activities closely to ensure that construction practices align with our sustainability principles.

- Private Equity Platform

Gaw Capital aims to integrate the above sustainability approach into our private equity business unit.

At the due diligence stage, we will review the Pre-Investment Screening Questionnaire, which is designed to support stakeholders in their consideration of ESG factors during the investment process. Any potential ESG concerns are highlighted for our team to assess possible mitigation actions. Gaw Capital will ensure each investment has a suitable ESG-integrated business plan.

At the post investment stage, we will ask portfolio companies in which we invest in to commit to the upholding of high sustainability standards through the signing of an ESG declaration form, and through the exercise of Post-Investment Monitoring Questionnaire, so that we can assess the projects’ ESG performance. Once ESG factors are defined, goals are set, and processes are developed for improvement to advance its ESG agenda alongside the financial and operational performance, Gaw Capital will keep in close contact with the portfolio company to keep track of the progress and ensure all goals remain aligned.

Gaw Capital’s ability to influence ESG matters with respect to the companies in which we invest will vary depending on the asset class, investment structure and contractual rights. In cases where Gaw Capital has limited influence, such as where Gaw Capital is a minority shareholder and has limited governance rights and access to ESG-related performance, Gaw Capital will only apply those elements of this ESG Framework and the foregoing approaches that it determines to be practicable in light of the underlying facts and circumstances.

- Disclaimer

This ESG Framework was last updated in 2Q 2023. This ESG Framework will be reviewed on an annual basis for the alignment against industry best practices and in light of any organizational changes or developments, and is subject to change as Gaw Capital considers necessary or advisable.

Gaw Capital Partnersは運用中のファンドを通して、コンソーシアムのパートナーと共に、2018年3月と2019年3月に、29件の香港ベースのコミュニティーショッピングセンターと関連施設を取得しました。Gaw Capital Partnersは、公共不動産付近の29件以上の資産と施設の運営を正式に開始し、「民坊(People's Place)」を構築しました。「民(People)」は一般人と住居を表しており、「坊(Place)」は巧みに管理されたコミュニティーのみならず、美徳と伝統がある場所に対するイディオム的な中国の表現を意味しています。また、「坊」は、現地の近隣の団結も暗示しています。「民坊(People's Place)」は活気に溢れ、居心地の良い生活環境で見知らぬ者を団結させ、気持ちや思いやりが豊かな場所を表しています。「民坊(People's Place)」は、空間を時代遅れの商用施設をクリエイティブで活気あるコミュニティーハブに転換させることを目指しています。

Gaw Capital Partnersは運用中のファンドを通して、コンソーシアムのパートナーと共に、2018年3月と2019年3月に、29件の香港ベースのコミュニティーショッピングセンターと関連施設を取得しました。Gaw Capital Partnersは、公共不動産付近の29件以上の資産と施設の運営を正式に開始し、「民坊(People's Place)」を構築しました。「民(People)」は一般人と住居を表しており、「坊(Place)」は巧みに管理されたコミュニティーのみならず、美徳と伝統がある場所に対するイディオム的な中国の表現を意味しています。また、「坊」は、現地の近隣の団結も暗示しています。「民坊(People's Place)」は活気に溢れ、居心地の良い生活環境で見知らぬ者を団結させ、気持ちや思いやりが豊かな場所を表しています。「民坊(People's Place)」は、空間を時代遅れの商用施設をクリエイティブで活気あるコミュニティーハブに転換させることを目指しています。

中国で経験豊かな教育者と提携し、Gaw Capitalは中国での国際的な芸術教育プラットフォームであるStellart International School of Arts (SISA )の開発と運営に投資してきました。このプラットフォームは、広州南駅から国内的に優れた接続性を有する仏山の南海にある三山ニュータウンにある便利な商業用地で誕生しました。敷地は約50,000m²の総床面積を有しています。SISAブランドで運営され、Gaw Capital Partnersにより開発されたこのスクールは6階建ての校舎と7階建ての寮に最大600人の高校生を収容します。

中国で経験豊かな教育者と提携し、Gaw Capitalは中国での国際的な芸術教育プラットフォームであるStellart International School of Arts (SISA )の開発と運営に投資してきました。このプラットフォームは、広州南駅から国内的に優れた接続性を有する仏山の南海にある三山ニュータウンにある便利な商業用地で誕生しました。敷地は約50,000m²の総床面積を有しています。SISAブランドで運営され、Gaw Capital Partnersにより開発されたこのスクールは6階建ての校舎と7階建ての寮に最大600人の高校生を収容します。